| Introduction: Understanding the U.S. Economy Today |

| The U.S. economy is a complex machine with many moving parts. Today, it’s a blend of robust recovery, ongoing challenges, and ever-evolving global influences. As the world’s largest economy, what happens in the United States ripples across the globe. In recent months, economic news in the U.S. has been dominated by inflation concerns, fluctuating stock markets, housing prices, and government fiscal policies. Let’s dive into these key economic trends to understand where the U.S. economy stands right now. |

| Key Economic Indicators and Their Impact |

| GDP Growth Rate |

| The Gross Domestic Product (GDP) is a key barometer for any economy, reflecting its overall health. The U.S. GDP growth rate has been a focal point in recent months as it shows how quickly the ndtopnews.com is recovering post-pandemic. The latest reports show modest growth, but some economists remain cautious, especially considering the slowdowns in consumer spending and business investment. While GDP growth indicates recovery, experts are keenly watching how sustainable it is amidst rising interest rates and potential global slowdowns. |

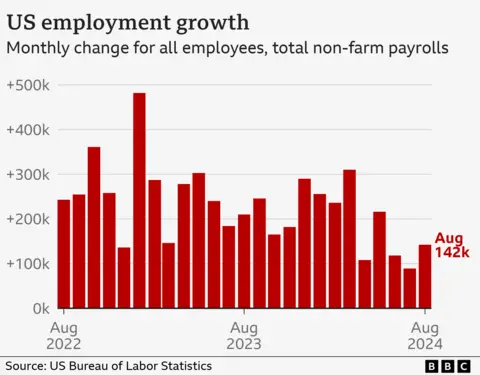

| Unemployment Rate |

| The unemployment rate in the U.S. has decreased significantly since the pandemic, with numbers now hovering around historically low levels. However, while many industries are seeing job growth, certain sectors—like tech and retail—are facing layoffs and hiring freezes due to economic uncertainty. The mismatch between available jobs and worker skills is also a growing concern. While the unemployment rate looks good on paper, the labor force participation rate and underemployment still highlight potential areas of concern. |

| Inflation and Consumer Prices |

| Inflation has been one of the most talked-about economic issues in 2024. With prices for goods like groceries, gas, and housing rising faster than many wages, inflation is impacting American consumers in a big way. The U.S. Federal Reserve has raised interest rates in an attempt to curb inflation, but the road to stabilizing prices has been challenging. Inflation in essential goods is often felt more acutely by lower-income households, raising questions about wage growth and the future of the cost of living. |

| Stock Market Trends: Up or Down? |

| Wall Street’s Performance |

| The stock market has been on a roller coaster ride recently. After a strong recovery from the pandemic downturn, investors are now grappling with the effects of higher interest rates, rising inflation, and global uncertainties. The S&P 500 and Dow Jones have experienced significant volatility, leading to investor unease. Stock market performance is closely tied to consumer sentiment and corporate earnings, so when either of those takes a dip, you’ll likely see a dip in market performance as well. |

| Tech Stocks vs. Traditional Sectors |

| One of the biggest stories in the U.S. economy is the difference between the performance of tech stocks and traditional industries. Tech giants like Apple, Microsoft, and Tesla were once the darling of investors, with explosive growth driving stock prices to new heights. However, rising interest rates have made future earnings from tech companies less appealing, causing a downturn in many tech stocks. Conversely, sectors like energy and healthcare have gained traction due to strong demand and stable profits. |

| The Federal Reserve and Interest Rates |

| The Federal Reserve has been active in adjusting interest rates to manage inflation and encourage or restrict economic activity. Recently, the Fed has raised rates multiple times to control inflation, and this has led to higher borrowing costs for individuals and businesses alike. While higher rates are slowing down some sectors like housing and consumer credit, they are also helping to cool down runaway inflation. As a result, the Fed’s decisions are often a balancing act, trying to manage both growth and price stability. |

| Housing Market: A Booming or Busting Trend? |

| Home Prices and Demand |

| The housing market has been a major topic of discussion in the U.S. economy. Over the past few years, home prices have surged to record highs, fueled by low mortgage rates, high demand, and a limited supply of homes. However, rising interest rates have cooled the market in 2024, leading to a slowdown in home sales. The once-hot housing market is now seeing more price adjustments, particularly in expensive urban areas. In some regions, home prices are finally stabilizing, but affordability remains a significant issue for many first-time buyers. |

| Mortgage Rates and Buyer Confidence |

| Mortgage rates are one of the biggest factors in the housing market’s trajectory. With the Fed’s interest rate hikes, mortgage rates have climbed, making it more expensive for buyers to finance a home purchase. This has led to reduced demand and a slowdown in new home builds. Additionally, consumer confidence has taken a hit, as many potential buyers are uncertain about the long-term direction of the economy. This has caused some prospective homeowners to put off their decisions, further impacting the housing market. |

| Real Estate Investment Trusts (REITs) and Market Fluctuations |

| Real Estate Investment Trusts (REITs) have been experiencing fluctuations in the market, particularly as interest rates rise. REITs, which allow people to invest in property without buying actual real estate, are sensitive to the cost of borrowing. Higher interest rates typically mean lower REIT valuations, leading to challenges for investors in this sector. However, REITs focused on commercial and industrial properties, like warehouses and office spaces, have seen growth due to ongoing e-commerce trends and remote work. |

| Consumer Confidence and Spending |

| Retail Sales Trends |

| Consumer spending accounts for a large portion of U.S. economic activity, and it’s a critical area to watch. Retail sales have shown mixed signals in 2024, with some sectors—like luxury goods and technology—remaining strong, while others, like clothing and home goods, are seeing slower growth. The economic uncertainty has led to some caution among shoppers, but overall spending remains resilient. The key question now is whether the consumer confidence surge that fueled post-pandemic retail growth will continue in the face of rising prices. |

| Automobile Industry Growth |

| The automobile industry in the U.S. is another sector that’s been heavily influenced by economic conditions. While car sales were booming post-pandemic due to pent-up demand, 2024 has seen some signs of slowdown, partly due to higher financing costs and supply chain issues. However, electric vehicle (EV) sales have been a bright spot in the industry. Automakers are betting on EVs as the future, and government incentives for EV purchases are helping to boost their adoption. |

| Government Economic Policies and Stimulus |

| Biden’s Infrastructure and Economic Plans |

| The Biden administration has rolled out a comprehensive plan aimed at rebuilding U.S. infrastructure and tackling climate change. The plan includes significant investments in roads, bridges, clean energy, and broadband access. While the $1.9 trillion American Rescue Plan has received praise for its efforts to provide direct financial assistance, many argue that the focus should also include tax reforms and long-term investments in education and job training to address systemic challenges in the economy. |

| Tax Reforms and Stimulus Checks |

| Alongside infrastructure plans, tax reforms have been a hot topic in Washington. The Biden administration has proposed tax hikes on the wealthy to help pay for social services and climate action, though this has faced resistance from Republicans. Meanwhile, stimulus checks during the pandemic provided much-needed relief for millions of Americans, and there’s ongoing debate over whether future stimulus measures are necessary to keep the economy growing. |

| How Government Spending Affects Economic Recovery |

| The government’s stimulus programs played a crucial role in supporting the economy through the pandemic, but there are concerns about long-term inflation and debt accumulation. As the economy recovers, the question is whether continued government intervention is necessary, or if private sector growth can take the lead. |

| International Trade and Global Economic Relations |

| U.S. Trade Deficit and Exports |

| The U.S. has been running a trade deficit for years, importing more goods than it exports. This deficit has been a point of contention in U.S. economic policy, with some arguing that it weakens the dollar and leads to loss of manufacturing jobs. However, exports remain strong, particularly in sectors like agriculture, technology, and services. The U.S. continues to push for more favorable trade agreements with countries like China, Mexico, and the EU. |

| The Impact of U.S.-China Trade Relations |

| The trade relationship between the U.S. and China continues to be a focal point in global economic news. The U.S. has imposed tariffs on Chinese goods, while China has retaliated with tariffs of its own. This has led to an uneasy economic landscape for businesses, as they navigate the costs of doing business in both markets. There are ongoing negotiations aimed at easing tensions, but much remains to be resolved. |

| Tech Innovations and Their Economic Impact |

| Silicon Valley’s Contribution to GDP |

| Tech innovation, especially in places like Silicon Valley, continues to drive U.S. economic growth. Companies like Apple, Google, and Amazon contribute significantly to the nation’s GDP, and the tech sector remains a key player in global economic dynamics. With the rise of artificial intelligence, the economic impact of tech is likely to grow even more in the coming years. |

| AI, Automation, and the Job Market |

| The rise of automation and artificial intelligence is changing the job market. While these technologies promise higher productivity and lower costs, they also raise concerns about job displacement. In sectors like manufacturing, logistics, and even retail, machines are replacing human workers. How the U.S. economy adapts to this shift—by retraining workers and investing in new industries—will be key to long-term growth. |

| Conclusion: What’s Next for the U.S. Economy? |

| The U.S. economy is at a crossroads. While recovery is well underway, challenges like inflation, rising interest rates, and job market shifts remain. Economic uncertainty is likely to continue, with the need for smart policy decisions and adaptive business strategies. For now, the U.S. economy is trying to balance growth with stability, and it will take concerted effort across sectors to ensure a prosperous future. |

:max_bytes(150000):strip_icc()/celebrity3-bdb0ea2b4b7b491caf84e603794198e8.png)